Guest Post by Willis Eschenbach (Yeah, I’m still wrongly blocked on X. See here for updated details.)

One of the greatest joys in my life is learning. Today, to my dismay, I learned that there are US tax credits for the meaningless job of removing CO2 from the air. Here’s a summary from perplexity.ai:

Summary of the U.S. 45Q Tax Credits

Overview

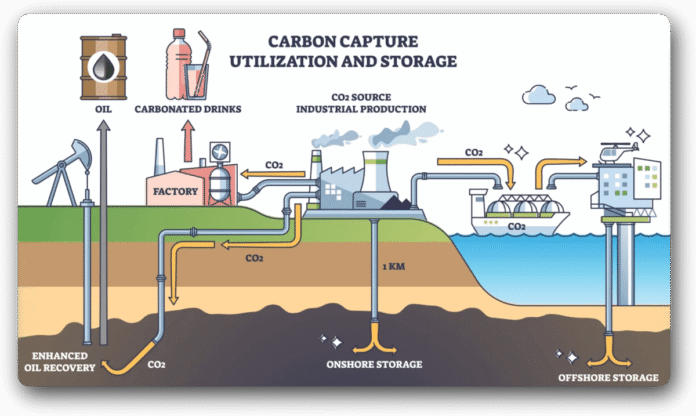

The U.S. Section 45Q tax credit is a federal incentive designed to support carbon capture, utilization, and storage (CCUS) projects. It provides a performance-based tax credit for capturing and either securely storing or reusing carbon oxides (including CO₂ and CO) from industrial, power, and direct air capture (DAC) facilities 1 2 3 5.

Credit Amounts (as of 2025, with prevailing wage requirements met):

| Project Type | Credit per Metric Ton CO₂ |

| Secure geologic storage (industry/power) | $85 |

| Carbon reuse (fuels, chemicals, products) | $60 |

| Secure geologic storage (oil/gas fields) | $60 |

| Secure geologic storage (DAC) | $180 |

| Carbon reuse/EOR (DAC) | $130 |

- Lower base rates apply if prevailing wage requirements are not met (e.g., $17/ton for industrial storage, $36/ton for DAC storage) 3.

Eligibility and Requirements

- The owner of the carbon capture equipment claims the credit 1 2 3.

- The captured carbon must be securely stored in approved geologic formations or reused in qualifying products (e.g., fuels, chemicals, building materials) 1 3.

- Projects must meet minimum annual capture thresholds (e.g., 1,000 tons/year for DAC, 12,500–18,750 tons/year for other facilities) 3.

- Credits are available for 12 years after the facility is placed in service 2 5.

- If stored carbon is later released, the credit must be repaid (credit recapture) 2 4.

Recent Enhancements

- Lowered annual capture thresholds, expanding eligibility 1.

- Credits can be transferred to other taxpaying entities or claimed as a direct payment for certain tax-exempt and government entities 1 3 4.

- Construction must begin by January 1, 2026, to qualify 2 5.

Purpose and Impact

- The 45Q credit aims to reduce the cost and investment risk for CCUS, encouraging broader deployment in hard-to-decarbonize sectors such as cement, steel, and power generation 1 5.

Key Takeaways

- 45Q is a major federal incentive for CCUS, offering up to $180/ton for DAC and $85/ton for industrial storage when prevailing wage conditions are met.

- The credit is flexible, transferable, and designed to spur private investment and accelerate decarbonization across multiple sectors 1 3 5.

(Note-each individual digit of the links shown above goes to a different source for the statement in question.)

Based on that, here’s a quick back-of-the-envelope calculation:

The US emits around 4.8 billion metric tonnes of carbon dioxide per year.

Average cost of the U.S. 45Q tax credits is on the order of $130 per tonne.

So to offset the US emissions using carbon capture would cost us a mere 625 billion dollars per year.

This is just under a third of the Federal Income Tax Revenue, so to offset it, our Federal Income Tax payments would have to increase by 50%!!

Can I contact DOGE by calling 911? Because this is assuredly an emergency …

w.

Yeah, you’ve heard it before: When you comment, please quote the exact words you are discussing. It avoids endless misunderstandings.

Related

Discover more from Watts Up With That?

Subscribe to get the latest posts sent to your email.