ISLAMABAD: The Central Directorate of National Savings, also known as Qaumi Bachat Bank, has announced a minor rise in the Profit Rate of Behbood Savings Certificates for April 2025, following its recent review conducted in March 2025.

The revised rates will be applicable throughout April 2025 until further notice is announced.

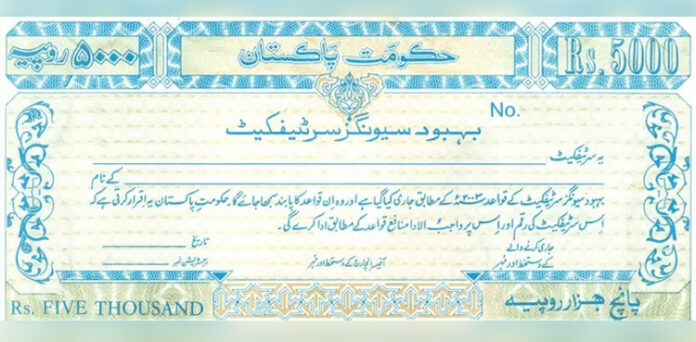

Behbood Savings Certificates were introduced in 2003, aiming to provide financial relief to widows and senior citizens through a constant monthly profit.

In 2004, disabled individuals and special minors were also added to the scheme to include them under the custody of eligible caretakers.

Latest Profit Rate for Behbood Savings Certificates

According to the latest revision, the Behbood Savings Certificates Profit Rate for April 2025 has been updated to 13.68%. It means that an investment of Rs 100,000 will give a monthly profit of Rs 1,140.

Eligibility Criteria

The following Pakistani citizens are eligible to purchase Certificates:

- Senior citizens aged 60 years or above.

- Single widows who have not remarried.

- Two eligible individuals (senior citizens or widows) in joint names.

- Disabled persons holding a NIC with Disability logo, and special minors through a guardian.

Investment Limits

The maximum investment limit for a single individual is Rs7.5 million, while joint investors can invest up to Rs 15 million.

Denominations Available

Behbood Savings Certificates are available in the following denominations:

- Rs5,000

- Rs10,000

- Rs50,000

- Rs100,000

- Rs500,000

- Rs1,000,000.

For more details on the latest profit rates, visit the official National Savings Pakistan website here.

Read More: Defence Savings certificates: Latest profit rate; April 2025

Earlier, the Central Directorate of National Savings set a competitive profit rate for Defence Savings Certificates in April 2025.

This rate, updated in March 2025, stayed in effect until the next adjustment. Aimed at Pakistani citizens, including those living abroad, these certificates offered a 10-year investment opportunity.

Both Pakistani nationals and overseas Pakistanis could invest, and adults could also buy them on behalf of one or two minors, or jointly with a minor.