This sequence of events will unfold during our remaining lifetimes. It starts with oil production from the Permian Basin in Texas peaking this year and then declining from 2026 at the rate of about one million barrels per day per annum. This will add to the rate of decline of oil production outside the United States already in train at about one million barrels per day per annum.

The oil price responds to this tightening of supply and rises through US$110 per barrel which is the price at which converting coal to synthetic liquid fuels becomes profitable. Coal becomes priced at the price of oil less the cost of conversion. It becomes just as expensive to produce electric power from coal as it would be to use oil as the energy source.

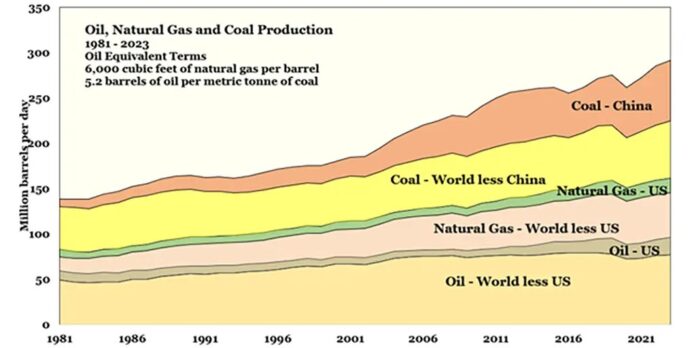

Figure 1: This graph shows total world fossil fuel production by type. In oil and gas, it was production from the United States that supplied demand growth so the US contribution in those sectors is separated out. Similarly in coal, China supplied all the growth in supply over the last 15 years. Without these two factors, the cost of energy would have risen.

While this is happening, the cost of power from nuclear reactors remains much the same and so becomes far cheaper than coal for power generation. The problem for humanity is that there isn’t a great deal of unmined uranium available to be brought into production. Current total fossil fuel consumption is near to 300 million barrels per day in oil equivalent terms. It is expected to fall by 100 million barrels per day by 2040 with half that due to Chinese coal production falling.

To replace that fall with nuclear power using the current dominant technology of U235-burning light water reactors would be difficult because it would require an expansion of uranium mining from the current rate of about 70,000 tonnes per annum to ten times that amount by 2040. The difficulty comes from the fact that the remaining undeveloped uranium deposits around the world could only support a fraction of the new supply needed.

Figure 2: The important line in this graph is the green one at the top of oil production outside the United States. That peaked at about 80 million barrels per day in 2016 and by 2023 had fallen to 77 million barrels per day. That was more than made good by the growth demonstrated by the darker green line at the bottom of the chart of oil production in the United States. With oil production in the Permian Basin rolling over into decline, total world oil production will start falling. Similarly, growth in US natural gas production rose from eight million barrels per day in energy equivalent terms in 2006 to more than double that in 2023. The biggest contribution to world energy supply growth has been Chinese coal production rising from 20 million barrels per day in 2000 to 67 million barrels per day in 2023 in energy equivalent terms. They have also been importing another 500 million tonnes of coal per annum which is seven million barrels of oil per day in energy equivalent terms. China won’t be able to build nuclear power plants fast enough to offset the decline in energy availability that is coming.

There is a solution though in the form of all the uranium that has already been mined to date of 3.3 million tonnes. Only 0.4% of that has been fissioned and the rest remains available. This is because in the light water reactor route to nuclear power, the U235 content of the as-mined uranium is concentrated from 0.7% to around 4% to make fuel rods. The tails from this process is called ‘depleted uranium’ and grades 0.2% U235. There are some 2.8 million tonnes of depleted uranium in storage. Of the 15% of mined uranium that made it into fuel rods, only one thirtieth of that was consumed in the fission process and the rest remains available for recycling. This amounts to half a million tonnes, accompanied by about 5,000 tonnes of plutonium created by the neutron flux in the reactors. In fact, by the time fuel rods are pulled in the light water reactor route, half of the energy is coming from plutonium bred from U238 in the rods.

The way to utilise the uranium that has already been mined is to process the spent fuel to separate the plutonium from the uranium using a hydrometallurgical process called Purex (Plutonium Uranium Reduction Extraction). This involves dissolving the fuel in nitric acid and using solvent extraction with a mixture of tributyl phosphate and a hydrocarbon diluent. The fission products are also removed. The Purex process costs about USW$1,000 per kilo treated. Relative to the cost of providing a reactor with enriched uranium, this equates to a yellowcake (U3O8) price of US$160 per lb. It used to be higher than that but the disruption to the nuclear fuel supply chain caused by the Ukraine War has increased the cost of uranium enrichment. The cost of raw uranium, at its current price, contributes only US$0.003 per kWh to the cost of nuclear power. This is only five percent or so of the total cost of power from new-build reactors. The price of uranium could double or triple from the current price of US$64/lb of U3O8 without moving the needle much for the consumer.

Right at the beginning of the nuclear age it was realised that there would be a shortage of uranium at some stage. The world’s first commercial reactor at Shippingport, Pennsylvania in 1957 combined thorium in its fuel rods to breed that to uranium. By the late 1970s there was a lot of activity around the world in developing designs for plutonium breeder reactors. In France, the Phenix demonstration reactor at 250 MWe was commissioned in 1973 and followed by the Superphenix reactor at 1,200 MWe in 1985. It closed 13 years later after a political deal with the Greens who required it to be shut down. The Superphenix had operated with up to 96% availability. In Russia, the BN 350 demonstration reactor was followed by the BN 600 reactor with power output of 600 MWe. This reactor was brought online in 1980 and will operate to at least 2040. In turn that was followed by the BN 800 of 880 MWe in 2016. Russia has had decades of stable plutonium breeder reactor operation. If Russia can do that, so can we.

Plutonium breeder reactors can be designed to have a breeding margin of up to 40%, that is they will produce 40% more plutonium than they consume. As a practical matter they are usually designed to operate with a breeding margin of 20%. Thorium has a theoretical breeding margin of 8% but is only likely to be able to wash its face in a practical design and thus might need help from excess plutonium to get it over the line in terms of neutron economy. This is important because there is four times as much thorium that can be mined than uranium. A truly high-level civilisation would start working towards that end now.

David Archibald is the author of The Anticancer Garden in Australia

Related

Discover more from Watts Up With That?

Subscribe to get the latest posts sent to your email.